What is Cyclical Arbitrage?

Cyclical Arbitrage is the practice of taking advantage of a price difference between two or more markets for significant return on investment, over recurring commodity cycles. Through Turnstone’s Systems Approach to cyclical arbitrage, we help you take advantage of these opportunities.

Our methodology is groundbreaking because it identifies and times the supply and demand cycles and their effect on commodity prices. It integrates Sentiment as a component part of price, and easily accommodates volatility through our scenario-based approach. Sentiment is a key element because it accounts for the swarming of human behaviour, i.e. the collective view of what future fundamentals (i.e. supply and demand) and future volatility will be, which is what the markets will tend to act on.

For example, it is only Sentiment that can allow for both rising inventory and rising prices at the same time! In a way, our approach accounts for irrationality, which is ultimately temporary, until the markets revert to the fundamentals.

Using key indicators, we can show you:

- What part of the commodity cycle you are currently in

- What are the most effective strategies and tactics to employ in order to realize significant returns on your investment

- Where to best make your investment, and

- How best to protect your existing investments.

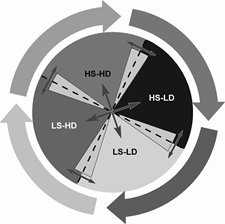

HS-LD and LS-LD = Value Creation

LS-HD and HS-HD = Value Extraction

HS-HD: Supply and Demand are both growing; however Supply is catching up to and outstripping Demand. Inventories are low and fundamental price at a high.

HS- LD: Supply has caught up to and exceeds Demand. Inventories begin to build, and fundamental price begins to fall.

LS-LD: Supply and Demand growth are both low or negative; however Demand is catching up to and outstripping Supply. Inventories are high and fundamental price at a low.

LS-HD: Demand has caught up to and exceeds Supply. Inventories begin to fall, and fundamental price begins to rise.