Trusted, independent advisors on crude oil and natural gas market trends

Arming you with the knowledge and insights to make the right business and investment decisions

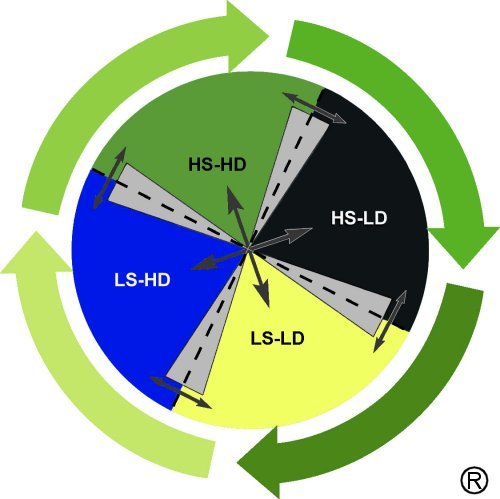

Cyclical Systems Approach

At Turnstone Strategy we have developed a unique cyclical methodology to guide our market and price analysis, one that has a proven success rate over traditional linear forecasting. We leave no stone unturned in our evaluations.

Our methodology identifies and times the commodity supply and demand cycles and their effect on commodity prices. We use meticulous research and analysis to provide you with advice and information on what part of the commodity price cycle we are in – whether supply is rising and demand is falling or vice versa — what strategies and tactics you should employ to realize meaningful returns on your investment, where to make your best investment, and how to protect your existing investments.

Our focus is on cyclical arbitrage – that is taking advantage of commodity price differences between two or more markets so you can get a significant return on your investment over recurring commodity cycles.

Our forecasting incorporates Market Sentiment – human behavior and the collective view of what the future supply and demand and future volatility will be – because after all, that’s what markets act on.

HS-HD — High Supply, High Demand

HS-LD — High Supply, Low Demand

LS-LD — Low Supply, Low Demand

LS-HD — Low Supply, High Demand

Here’s how it works

In a high supply, high demand scenario, supply and demand are both growing, However, supply is catching up to and outstripping demand. Inventories are low and the fundamental price is at a high. This is a good time to extract value from the markets.

In a high supply, low demand scenario, supply has caught up to and exceeds demand. Inventories are beginning to build and the fundamental price begins to fall. This is a value creation opportunity.

In a low supply, low demand scenario, supply and demand growth are low or even negative, however, demand is catching up and outstripping supply. Inventories of the commodity are high and the fundamental price is low. This is a value creation opportunity.

In a low supply, high demand scenario, demand has caught up to and is exceeding supply. Inventories are beginning to fall and the fundamental price is beginning to rise – a value extraction opportunity.

Our job is to ensure that you are out in front of the market armed with the knowledge and insights to make the right business and investment decisions.

Contact Us

3300, 205 - 5th Ave. S.W.

Calgary, Alberta, Canada

Phone: (403) 205-3255